over the past year

All-in-one payroll solution

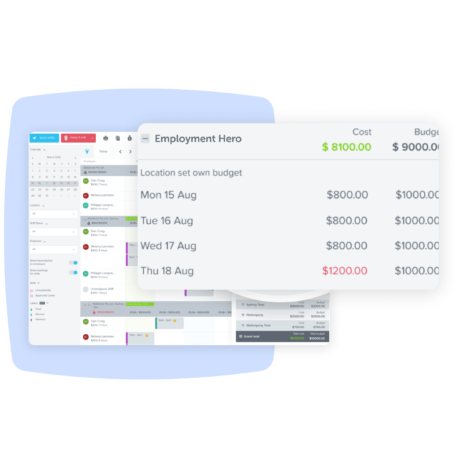

Automated online payroll

ATO-certified payroll reports

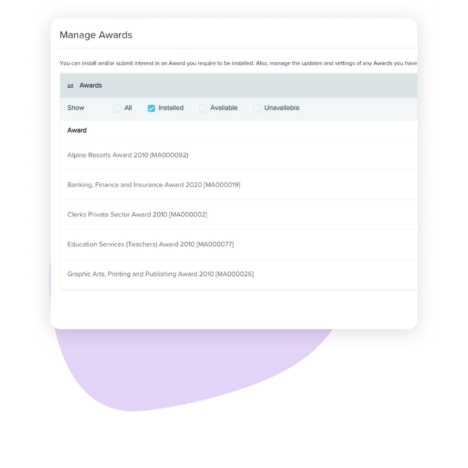

Modern award interpretation

Smart payroll integrations

Switch payroll solutions easily by importing employee time worked, leave taken and other employee information from your current payroll provider into Employment Hero.

Employment Hero integrates with popular payroll systems and accounting software, such as:

Our award-winning payroll software is recognised globally for providing outstanding product and customer experience.

Hear what our clients have to say

Payroll software FAQs

Payroll software helps businesses automate their payroll processes. This can include tasks like payroll processing, payroll calculation, tax filing, and detailed reports.

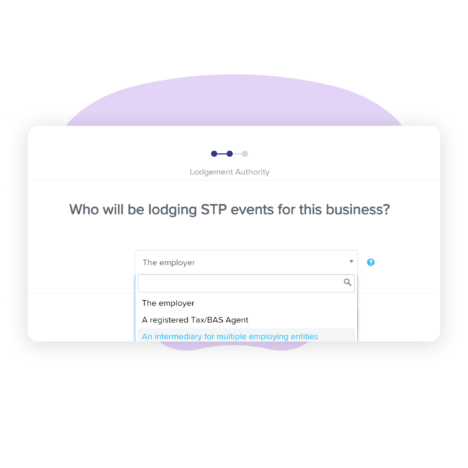

Single Touch Payroll (STP) legislation requires employers to report wages, PAYG withholding, and superannuation information directly to the ATO using an online payroll system.

One of the significant benefits of using payroll software is that it can help businesses avoid penalties for non-compliance with payroll tax laws. These laws can be complicated and subject to change, which can make it challenging for businesses to stay on top of their obligations.

Innovation, reliability, customer service. A tick, gold medal, five stars.

Proven success.

For payroll experts.

Join the league of successful businesses who've transformed their payroll operations with our reliable payroll software.

Resources. All for you.