Automated Payday Filing. Managed with ease.

Improve compliance

Pay your people

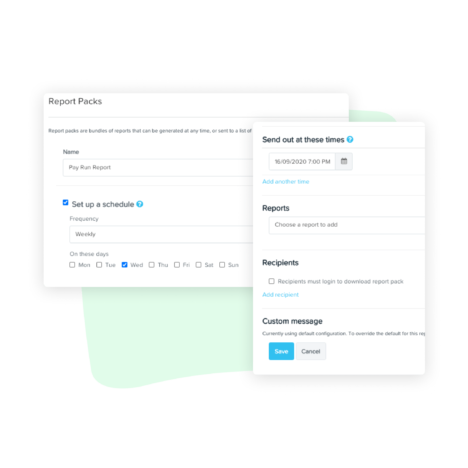

Seamless reporting

View dates, times, locations and images of each attendance activity recorded via Clock Me In. Cross reference activities against timesheets and rosters to eliminate uncertainty around shifts worked. You can even filter according to different locations, for businesses that operate across multiple venues.

Payday Filing FAQs

Payday filing is a system implemented by the New Zealand government to make it easier for employers to submit their employment information to the Inland Revenue Department (IRD).

This information includes the details of each employee, including their employee earnings, deductions, and KiwiSaver contributions for the pay cycle.

Payday Filing became mandatory in New Zealand on the 1st of April 2019. From this date, all employers are required to submit employment information through the Payday Filing system after every pay period.

Innovation, reliability, customer service.

A tick, gold medal, five stars.

over the past year

Resources. All for you.