Accurate data

Save time on manual calculations

For every employee scenario

We’re the all-in-one employment solution for businesses with big ambitions.

Leave management software FAQs

Leave management software is a tool that helps organisations manage employee absences, including vacation time, sick leave, and other types of time off. This software allows HR management and team leaders to easily monitor and approve employee time off requests while also providing employees with a streamlined process for requesting and tracking their time off.

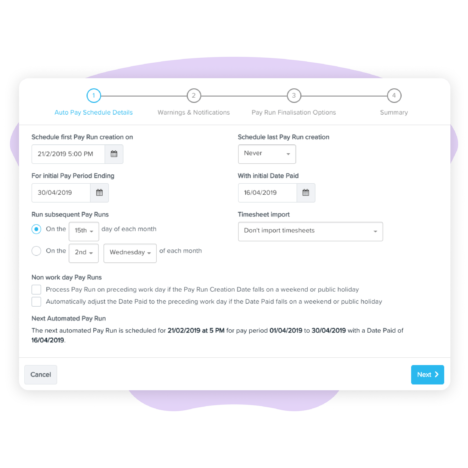

An employee leave management system provides a centralised platform to request, track, and manage leave requests. Employees can submit leave requests via the employee self-service portal, which are then reviewed and approved by HR managers or supervisors. The system tracks employee attendance in real-time, providing visibility into current and future employee scheduling needs.

HR software provides numerous advantages over traditional manual methods for managing leave requests. With a cloud-based HR software, both employees and managers can manage leave requests remotely from anywhere with internet access, making it particularly useful for companies with remote or distributed teams.

Innovation, reliability, customer service.

A tick, gold medal, five stars.

over the past year

Resources. All for you.